Ultracard

A digital third place that helps you engage with the world in a way that feels intentional, seamless, and deeply personalized.

Timeline June to July 2024

Role UX Designer

Tool Figma

Context

Financial planning is daunting.

Many young adults find financial planning daunting, whether it's dealing with investments, managing funds, or using credit cards. This apprehension is understandable, given the widespread lack of financial literacy. Ultracard is a new type of card designed to simplify spending and earning rewards, easing the financial planning process. This project aims to develop the Ultracard product and create a responsive web design for it.

Problem Space

Cash, Debit or Credit?

Many are frustrated by juggling multiple cards for different benefits, including switching between debit and credit. This is compounded by numerous brand-reward programs, leading to concerns about unhealthy financial decisions and feeling unprepared for financially independent adulthood.

Challenge

To create a card that could essentially simplify the different financial products that have saturated the market, providing user with an options that is easy to use, and easy to understand.

Process

Research Summary

Starting off with secondary research, I decided to look at what other card-based solutions are being offered by financial institutions. This was also accompanied by looking into offerings from non financial institutions

(eg: Apple, Rogers, Walmart, President’s Choice etc.).

This included asking peers about their preferred choices, and what kind of benefits do they prefer when choosing a new card - points or cash back. I also looked at the benefits that payments networks (Amex, Mastercard, and Visa) provided their customers.

There was a preference for a cash back rewards because of lower annual fees, and less restrictive redemption. The best part about cash back cards is their simplicity - they let you earn a fixed percentage of the amount you spend as cash back. Most cards offer at least 1% cash back on all purchases. Some cards provide up to 6% cash back on bonus categories, but that may come with limits or restrictions.

Based on the user personas, four general themes can be observed:

Financial Literacy and Education

Optimization of Credit Card Benefits

Convenience and Simplification

Decision-Making and Uncertainty

Design Principles

Adaptive

Ultracard and its promotional pieces need to be flexible and adaptable to the different payment methods, as well as move responsibly across different screens.

Simplified

The complexity of managing multiple cards and rewards systems is a common pain point. Simplified solutions that consolidate benefits can appeal to consumers seeking convenience, potentially leading to increased adoption and usage of such products.

Consistent and Valuable

Consumers are frustrated with diminishing credit card benefits, indicating a need for products that offer enduring value. Companies that provide transparent and stable rewards can build stronger customer loyalty and satisfaction.

Final Product

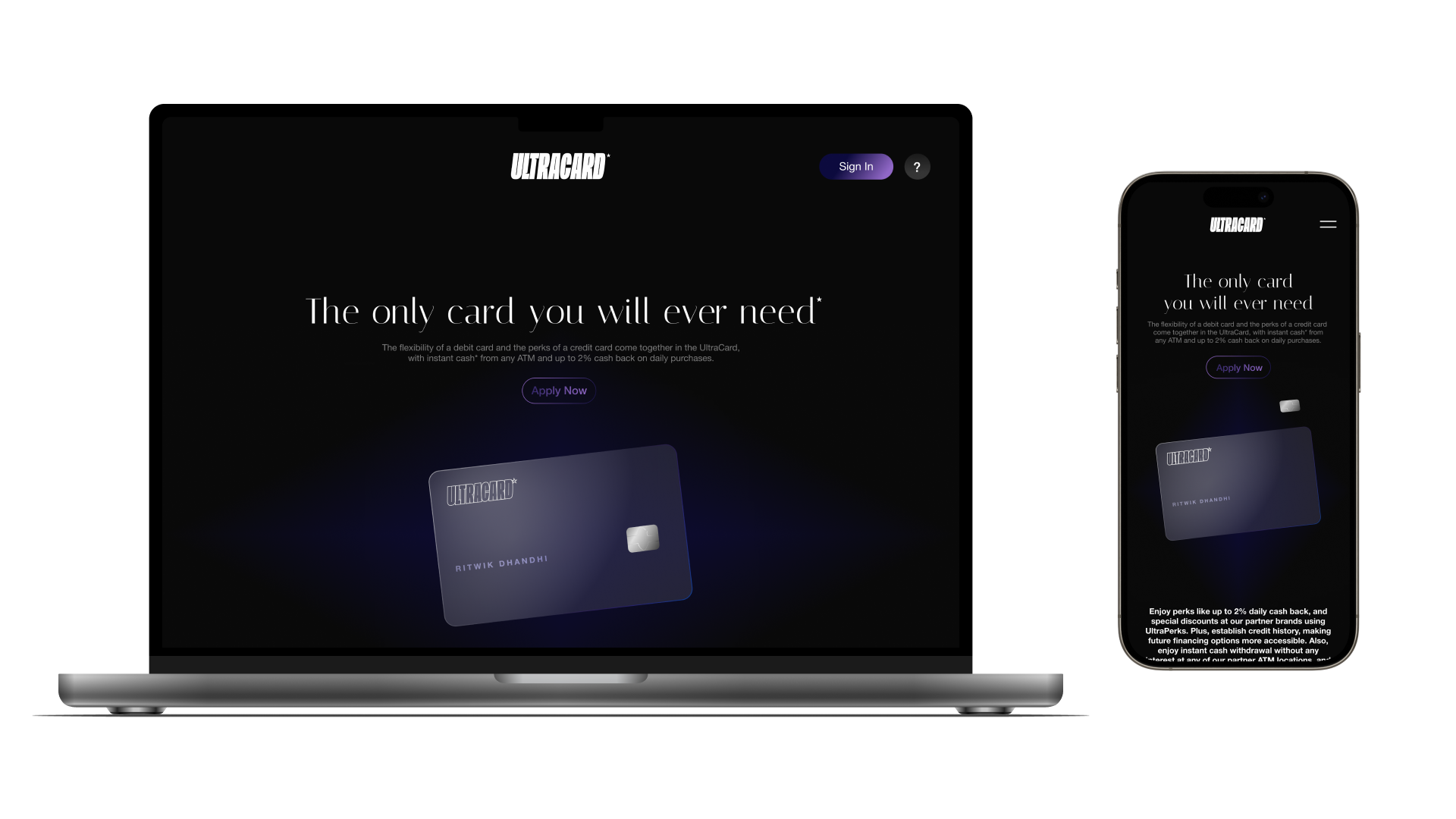

Ultracard is a versatile card that functions as both a debit and credit card, adapting to your financial needs. It offers up to 2% daily cash back, allowing you to enjoy the benefits and security of using your own money without incurring interest. Additionally, Ultracard enables cash withdrawals from any ATM worldwide and consolidates all your rewards programs, earning points with every purchase. It’s a debit card. It’s a credit card. It’s Ultracard.

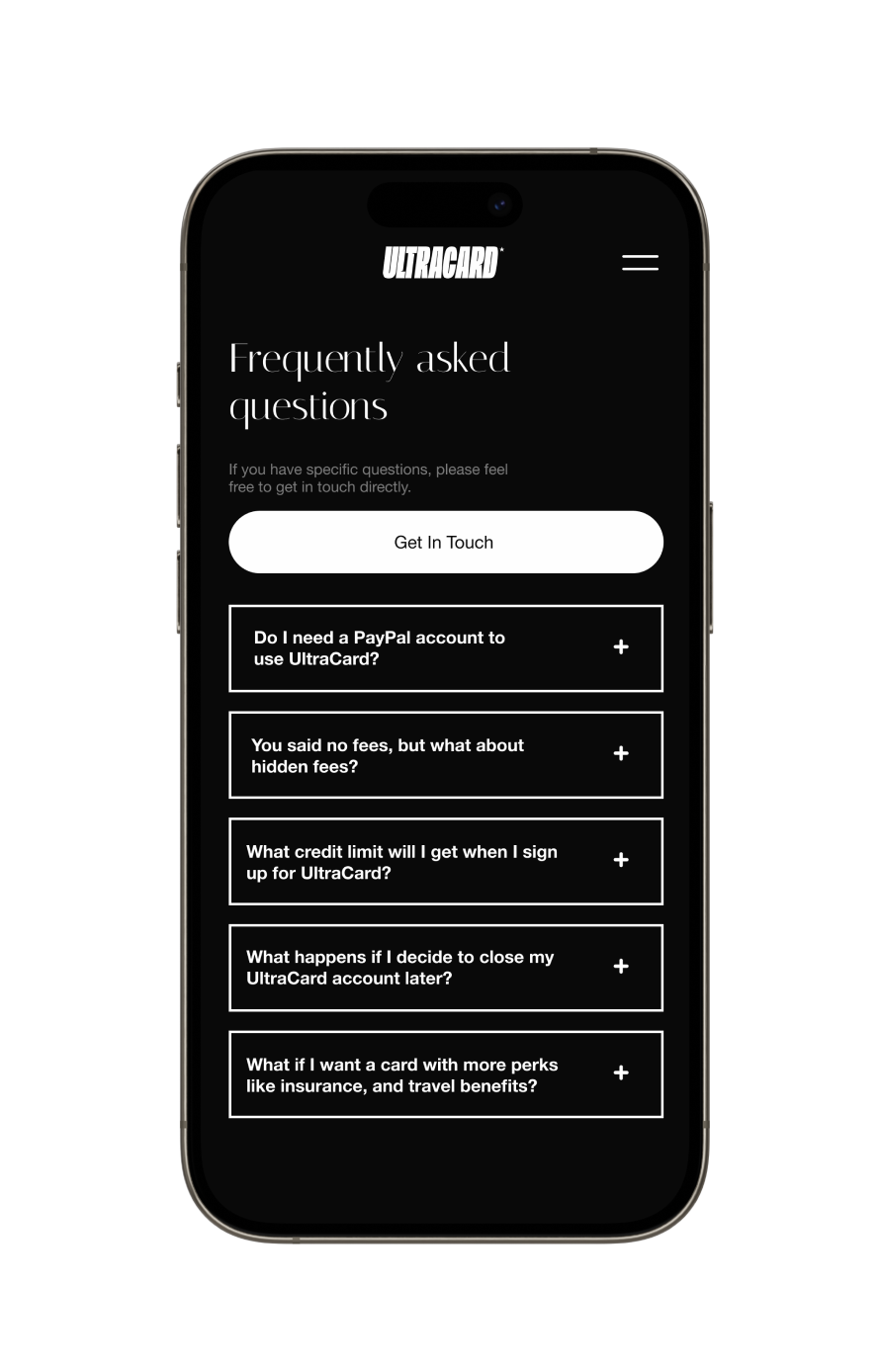

Explore the features of Ultracard using the responsive web design prototype.

Retrospective

Takeaway and Learning

Takeaway

I noticed that many people faced efficiency-related issues that hasven’t been solved. With Ultracard, I identified this latent concern and developed an effective solution, addressing a significant need and improving their daily lives.

Learning

I discovered that the principles of user-centred design can be applied to the everyday products we interact with, allowing us to enhance usability and create more delightful experiences. I've also come to understand that altering long-established societal norms is challenging but ultimately more rewarding.

Next Steps

I would like to keep testing this product further and hopefully keep on improving this product by optimizing the benefits and use cases.

I would also like to keep optimizing the website and refreshing it on a rolling basis to appeal to more users and use the trending web styles. I would also like to develop a high-fidelity prototype of the Ultracard app and test it further.

The Complete Process

See the research, branding, brainstorming, and the user testing process that led to the final product.